By Rachel Chang

The fate of Taiwan’s economy hangs in the balance as the semiconductor industry encounters mounting geopolitical pressures from the United States and China. Although Taiwan’s dominance in the chip market provides a short-term advantage, it also exposes the economy to vulnerabilities. Taiwan must diversify into other industries in order to achieve a more stable path of growth and development and protect itself against the fluctuations of the chips industry.

Taiwan’s rise to dominate the IC industry

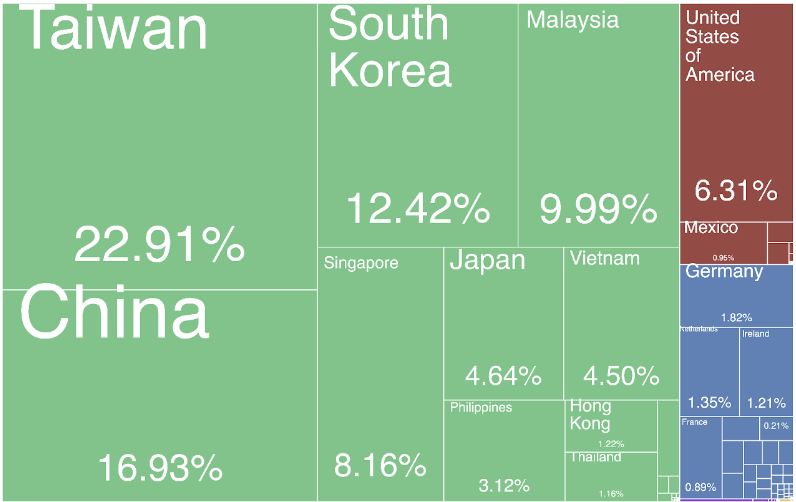

Taiwan is the leading producer of digital monolithic integrated circuits (ICs), exporting $164B annually or 23% of the entire world’s export supply. ICs, also known as microchips or chips, are the essential component of any electronic device, from smartphones to washing machines to cars and fighter jets, and powers the world’s digital infrastructure.

Figure 1: Electronic Integrated circuit (ICs) Exports by Country, 2020

(Source: Atlas of Complexity)

As China and many other countries attempt to close the gap in the global chip race, Taiwan remains home to more than 90% of the manufacturing capacity for the world’s advanced ICs.

The root of Taiwan’s chip manufacturing success can be traced back to the founding of the Industrial Technology Research Institute (ITRI), a government-supported nonprofit with the goal of promoting industrial technology development, in the 1960s. The institute worked with foreign partners to acquire IC technology and fund the incubation of the world’s top semiconductor foundries today: Taiwan Semiconductor Manufacturing Company (TSMC) and United Microelectronics Corporation (UMC).

Given budgetary constraints, TSMC and UMC operated fabrication plants that produced ICs for other companies, instead of designing its own products. This low-cost model, also known as the pureplay foundry model, began the interdependence of these Taiwanese IC suppliers and their international customers. It created specific knowledge areas in the IC and semiconductor industries, grew IC exports and drove Taiwan’s economic development.

Figure 2: Gross chip exports over time (left), Share of world’s chip exports (right)

(Source: Atlas of Complexity)

Why Taiwan’s stronghold in chip manufacturing is risky

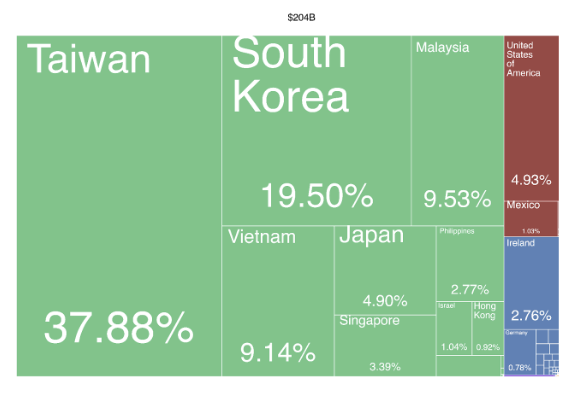

Today, ICs comprise 41.5% of all Taiwanese exports and 25% of GDP. This dependence has made Taiwan’s economy susceptible to a number of recent economic and political shifts, including China’s increased military exercises and TSMC production moves to the United States.

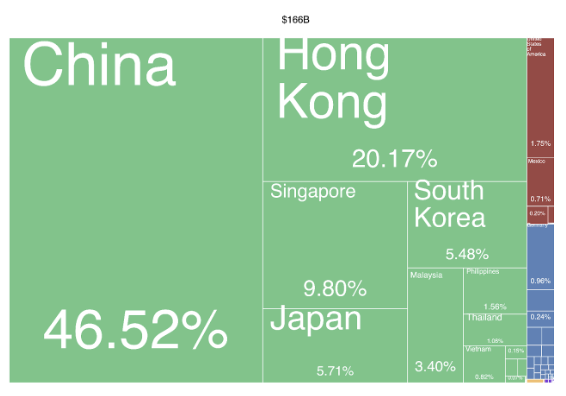

In October 2022, the Biden administration imposed a sweeping set of controls on the sale of advanced chips and chip-making equipment to Chinese firms. Given that 46% of Taiwanese IC exports go to China, the controls caused disruptions in the supply chain and resulted in reduced demand from Taiwan. China is also one of Taiwan’s biggest customers, importing 38% of ICs from Taiwan, further highlighting the dependence of Taiwan’s economy on Chinese markets.

Figure 3: Taiwan’s IC Exports, 2020

(Source: Atlas of Complexity)

Figure 4: China’s IC Imports, 2020

(Source: Atlas of Complexity)

With TSMC making up one-third of the value of the Taiwanese stock market and taking in about 10% of its revenue from China-based customers, TSMC shares fell 8.3% to its lowest close in more than two years.

Moreover, the growing semiconductor chip race between the United States, Europe, and Asia have made the future of Taiwan’s semiconductor chip production unpredictable. Each economy or regional block attempts to control the semiconductor production and not overly rely on the other for vital technology and materials.

What is Taiwan’s diversification story?

As these risks intensify, the question of diversification for Taiwan is less straightforward. Taiwan has reached the forefront of technology by producing and exploiting nearly all of the major products currently available. IC and semiconductor production, along with other electronics and machinery products have played a significant role in making Taiwan’s economy highly complex.

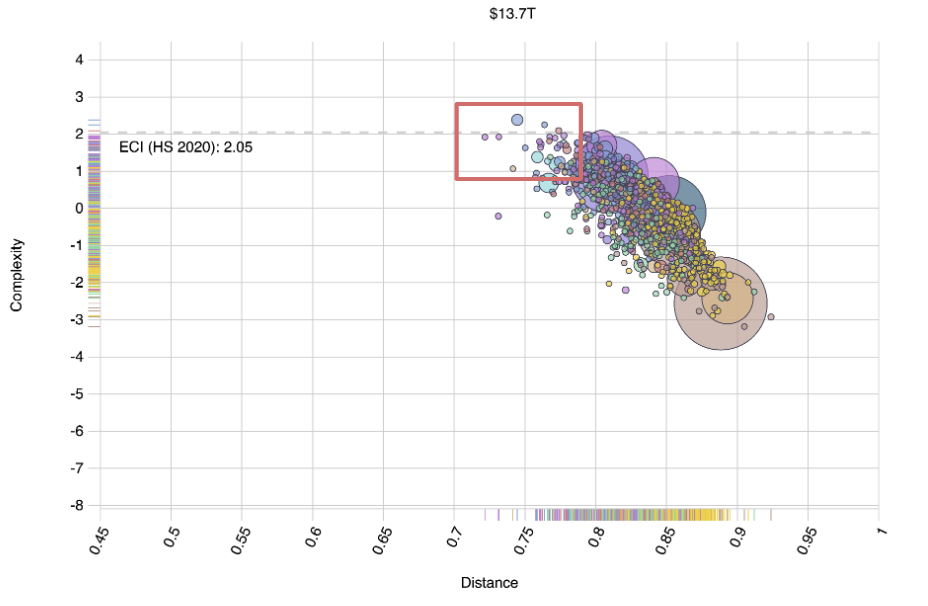

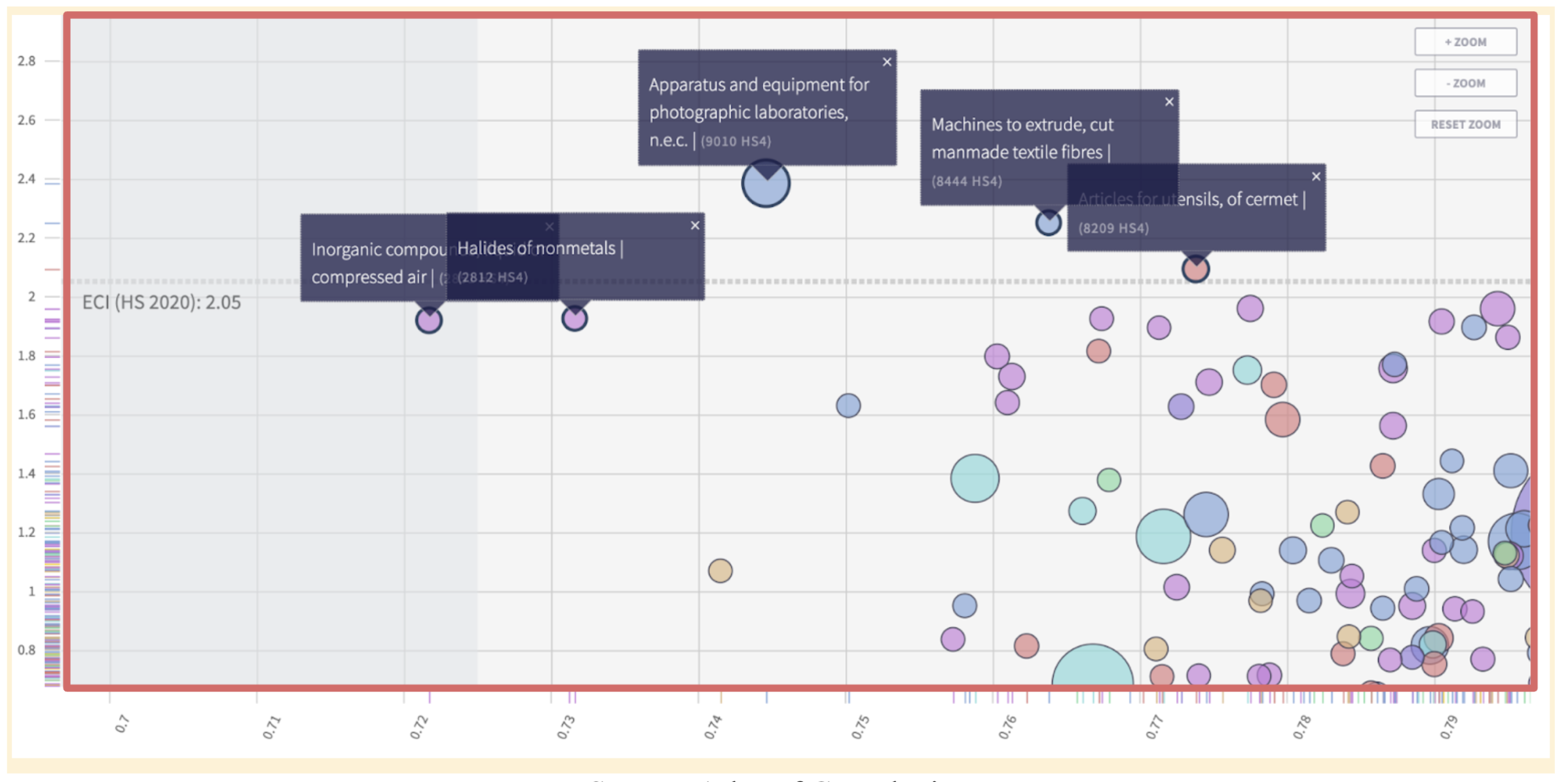

Taking a closer look at Taiwan’s Feasible Opportunities, we identify several potential products that are “closer” in distance and have relatively high complexity and could serve as potential candidates for economic diversification.

Figure 5: Taiwan’s Feasible Opportunities Graph Highlighting Several Products

(Source: Atlas of Complexity)

Apparatus and equipment for photographic laboratories could be promising new entrants for Hsinchu, Tainan and Zhuanghua City. This industry is a better technological fit to these cities than that of their selected peer groups. Photographic equipment and supplies merchant wholesalers also presents an opportunity in Hsinchu and Kaohsiung’s trade and transportation sectors.

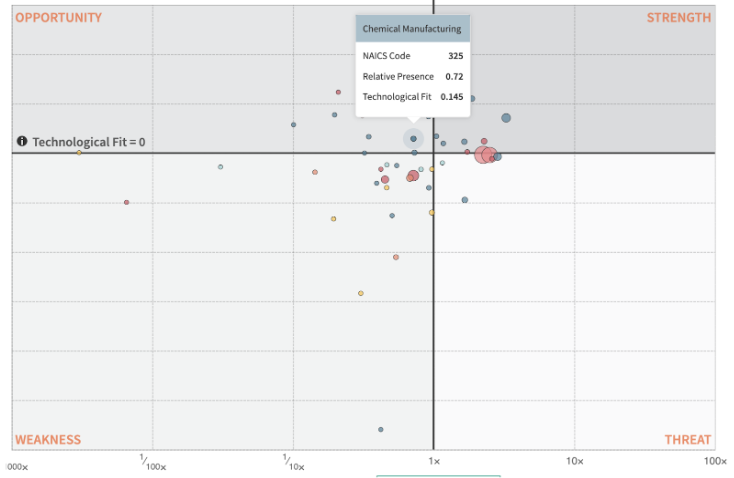

Figure 6: Kaoshiung Feasible Opportunities

(Source: Metroverse)

Chemical manufacturing is also an opportunity in the New Taipei Metropolitan Area, which aligns well with Taiwan’s suggested export opportunities in halides of nonmetals, inorganic compounds, and petroleum resins as indicated by Taiwan’s Feasible Opportunity graph.

Figure 7: New Taipei Metropolitan Area Feasible Opportunities

(Source: Metroverse)

However, when we look at potential products Taiwan could export overall in Figure 5, most of the opportunities are “far” away from Taiwan’s current capabilities, given the large minimum distances from Taiwan’s Economic Complexity Index (ECI) line, or the measure of how diversified and complex Taiwan’s total export basket is. It may take a few strategic jumps for Taiwan to diversify into these new products. The bulk of these feasible products are low in complexity, which may not be favorable to a highly complex economy. Therefore, diversification for Taiwan may mean promoting innovation and inventing new products.

Can a better story of diversification be illustrated at the city level?

Metroverse makes visible what a city is good at today to help understand what it can become tomorrow. Analyzing Taiwan’s diversification prospects at the city level yields a clearer picture of which industries have the highest potential based on the city.

The Telecommunications, Apparel Manufacturing, and Printing and Related Support Activities industries provide economic opportunities in most cities. Nonetheless, each city should focus on different specializations and pursue distinct diversification strategies. National policies could assist, but city-specific policies may have a more significant impact.

Figure 8: “Opportunity” Industries based on City

(Source: Metroverse)

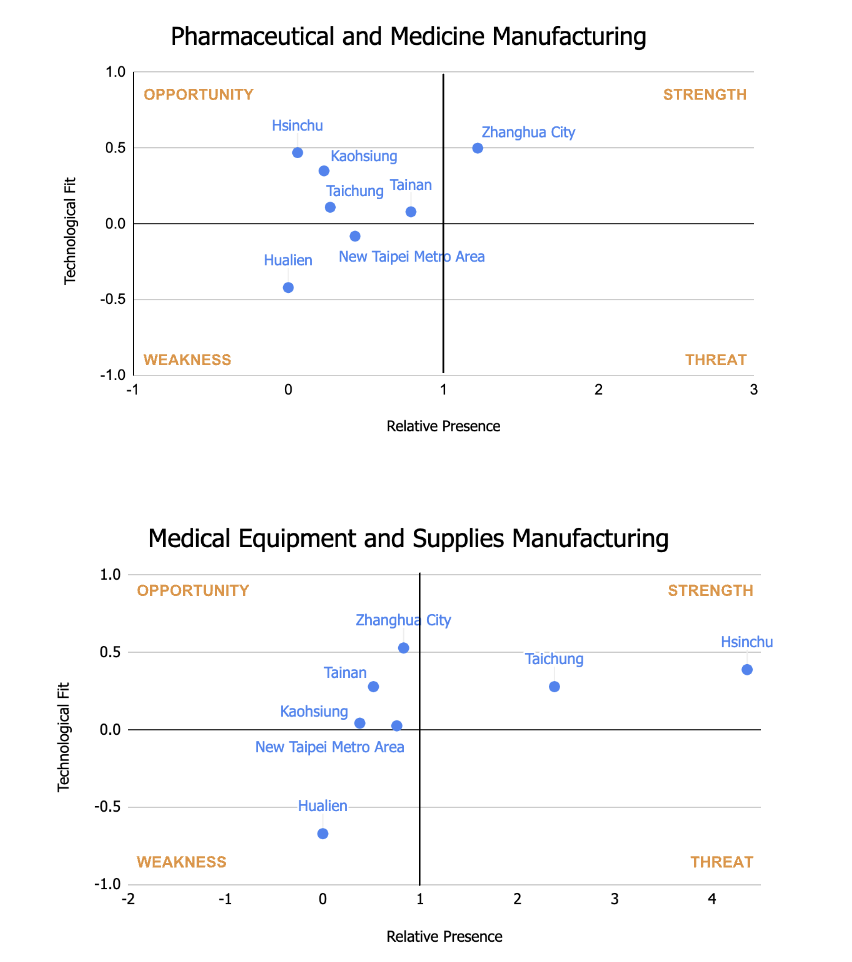

A case study for opportunities in the medical industry

Hsinchu, Kaohsiung, Taichung, Tainan, Taipei Metropolitan Area, and Zhuanghua are six major cities in Taiwan that have opportunities in either the Pharmaceutical/Medicine Manufacturing or the Medical Equipment/Supplies Manufacturing industries. As it turns out, these cities also have existing strengths in the semiconductor, IC, and electronic component manufacturing industries.

Figure 9: Growth Opportunities in Pharmaceutical Manufacturing (Top), Medical Equipment and Supplies Manufacturing (Middle), Semiconductor and other Electronic Component Manufacturing (Bottom)

(Source: Metroverse)

The potential for growth in the Pharmaceutical/Medicine Manufacturing and Medical Equipment/Supplies Manufacturing industries reflects Taiwan’s strategic goal of positioning itself as a worldwide hub for pioneering research and development in the fields of biomedical and life sciences. The government’s 2018 “5+2 Industrial Innovation Plan” indicates that biotechnology is one of seven key high-tech initiatives that will “serve as the central driver of Taiwan’s industrial growth into the next era.”

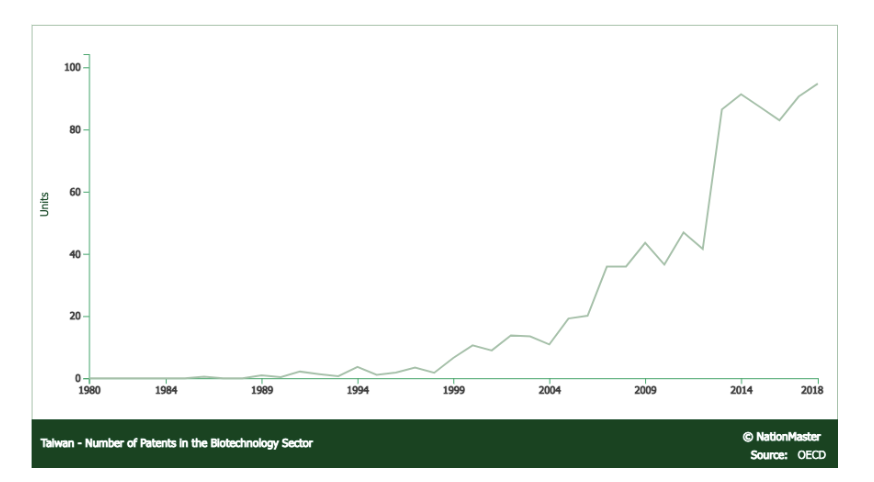

Taiwan has established biotechnology research parks in several cities, equipped with laboratory facilities, office space, and business development services, to support companies in the biotech and medtech sectors. The government has also streamlined market approval and R&D reimbursement timelines and made it easier for small companies to go public. As a result, the total market capitalization of local biotech companies has increased 700% since 2008, and patent data suggests a 1.9% year-on-year increase in biotech innovation.

Figure 11: Number of Patents in the Biotechnology Sector

(Source: OECD)

Looking forward

To lessen its dependence on the semiconductor industry and diversify its economy, Taiwan should explore further opportunities in industries, such as Telecommunications, Apparel Manufacturing, and Printing and Related Support Activities. These industries offer growth opportunities across several major cities.

In particular, the Telecommunications industry has great potential, and its three major providers, Chunghwa, Taiwan Mobile, and FarEasTon, could significantly contribute to this progress. They can do this by extending their 5G services, creating inventive IoT applications in areas such as smart homes, smart cities, and healthcare, emphasizing cybersecurity, promoting public-private partnerships, and investing in talent development.

Some experts suggest that Taiwan should broaden the geographic scope of TSMC’s operations and the semiconductor fabrication industry to other locations as part of its diversification strategy. However, this may not necessarily safeguard Taiwan’s economy. Therefore, apart from supporting broader national initiatives, Taiwan should consider implementing more targeted policies to cater to the unique needs and opportunities of each city’s industry growth potential.